05/03/2024

Changes in laws and regulations in the German social security system from 2024

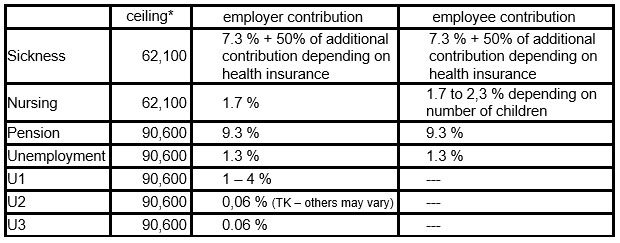

The contribution assessment ceiling for the calculation of pension and unemployment contributions will be in West-Germany 90,600 EUR per year (87,600 in 2023). In East-Germany, this ceiling increases to 89,400 EUR (85,200 in 2023). The social security ceiling for the calculation of health and nursing contributions increases to 62,100 EUR per year in 2024 (59,850 in 2023).

The contribution rates to the pension, health and nursing insurance remain unchanged. The contribution rate to the unemployment insurance increases from 2.4 to 2.6%.The additional health insurance contribution, which is individually defined by each health insurance increases in average from 1.3 to 1.6%. Following the membership of your employee in a specific health insurance, this additional contribution can be between 0.84 and 1.7%.

Overview of contribution assessment ceilings 2024:

*West-Germany

U1 levy fund

Employers must continue to pay their employees for up to six weeks if they are sick and unable to work. The U1 levy fund partially absorbs this burden for companies with up to 30 employees worldwide.

The health insurance fund U1 covers the costs of continued pay for employers with up to 30 employees. This U1 fund is financed by contributions, which are paid exclusively by the participating employers. In this way, the financial risk is distributed among all the companies. Every year, the employers must determine, based on the number of employees, whether the company is liable to pay contributions to the U1 fund or not.

The amount of the contribution rate U1 is regulated in the statutes of the respective health insurance and depends on the percentage of reimbursement chosen by the employer. There is a standard reimbursement rate offered by the insurances which we always chose for our clients.

The employer is reimbursed a percentage of the expenses for continued payment of wages, which the employer pays to employees who are unfit for work according to statutory regulations. The amount of reimbursement is determined by the statutes of the respective sickness insurance. It may not be more than 80 per cent and not less than 40 per cent.

The contribution U2 (maternity benefits) is mandatory for all employers. All employers paying U2 contributions receive a reimbursement of their continued salary payment during maternity of their employees.

The contribution rates U1 and U2 are determined by each health insurance and may vary from one health insurance to another.

The contribution U3 (contribution to the insolvency fund), which is mandatory for all employers remain unchanged and must be paid at a level of 0.06 % in 2024.

Employees can change from public health insurance to a private health insurance if their expected yearly income in 2024 will be higher than 69,300 EUR. If this applies their status in the public health insurance changes from obligatory to deliberate.